There is a lot happening in the payments world, and one of the most important interesting initiative is FedNow, the Federal Reserve’s real-time payment system. Real-time payments are the future of banking. These kind of systems have shown the Industry the value and impact it can bring to the ecosystem and customers. One of the classic example of the impact is UPI Story from India, which has revolutionized the banking landscape in India and now getting adoption across the world.

What is FedNow?

FedNow launched in July, with nearly 35 banks and credit unions being early adopters of the service. FedNow is geared to enable faster, more efficient transactions, enhance customer experience, and provide a competitive edge. It mitigates security risks, aligns with regulatory standards, and positions your bank as a leader in the evolving financial landscape.

The FedNow Service is available to financial institutions of all sizes, across all communities in America to provide safe and efficient instant payment services in real time, around the clock, 365 days a year.

FedNow, through its participating Financial Institutions enables businesses and individuals to send and receive instant payments instantly through convenient channels like web and mobile devices. Recipients will have access to transferred funds within a few seconds, providing them greater flexibility to manage their money and make time-sensitive payments.

FedNow plans to expand the services they can offer their customers. With FedNow US aims to be on par with countries such as India, the UK, Brazil and the European Union by enabling faster payments and eliminating the typical multi-day delay for settling cash transfers.

Why FedNow?

Real-time payments have gained significant traction due to many key drivers in the financial industry. The increasing demand for instant gratification in today’s fast-paced world has led to a growing need for immediate financial transactions. Consumers and businesses alike seek faster, more convenient payment options that eliminate delays and settlement windows. Additionally, the rise of digital commerce, mobile banking, and peer-to-peer payments has fueled the adoption of real-time payment systems. The push towards financial inclusion and the desire to cater to underserved populations have also played a pivotal role in promoting real-time payments, as these services can offer greater accessibility and financial empowerment to all. Furthermore, the competitive landscape in the financial sector has prompted institutions to embrace real-time payments as a means to differentiate themselves and stay ahead in the market. Overall, these drivers have culminated in a strong shift towards real-time payment solutions that meet the evolving needs of consumers and businesses alike.

Consumers and businesses are moving towards advanced payment practices that are better suited to their ever-evolving needs. Banks and credit unions that participate in the service can send and receive payments instantly for their customers, 24 hours a day, seven days a week. FedNow will benefit consumers and businesses by allowing them access to their paychecks immediately, enabling last minute bill payments and managing their cash flow more efficiently in real time.

The Fed already operates a real-time payments system called FedWire for large, mostly corporate payments, but the service is only available during business hours, unlike FedNow, which will be available 24/7.

Consistent with the Federal Reserve’s historical role of providing payment services alongside private-sector providers, the introduction of the FedNow Service will provide choice in the market for clearing and settling instant payments as well as promote resiliency through redundancy.

With financial institutions facing a pressing need to provide faster, more efficient, and secure payment services to meet customer expectations and remain competitive, FedNow, the Federal Reserve’s instant payment system, presents a compelling solution to address these challenges. Here are the key reasons why financial institutions should seriously consider adopting FedNow:

Speed Matters: FedNow allows financial institutions to offer real-time, 24/7 payments, enabling immediate fund transfers between customers and businesses. This should enhance customer satisfaction as the service will reduce payment processing times and eliminate delays.

Enhance Competitiveness: With a growing demand for instant payments, financial institutions that integrate with FedNow will be able to differentiate themselves in the market. Availability of real time payments will not only drive new customers acquisition but also help retain existing ones. Such value added service will boost the banks position in an increasingly crowded financial services landscape.

Modernize Legacy Systems: Many financial institutions who have been shying away from upgrading their legacy payment infrastructures, FedNow presents an opportunity to modernize these systems and improve overall operational efficiency.

Reduce Risk and Fraud: As real time payments offer instant payments confirmation, it will help financial institutions minimize the risk of fraud and unauthorized transactions. The instant settlement feature enhances the security of transactions, protecting both customers and financial institutions alike.

Support for Small Businesses: Small businesses that are under constant cash pressures stand to gain the most from FedNow. The fast and accessible payment system can significantly improve cash flow, leading to more stable operations and foster economic growth.

Seamless Integration: FedNow by design enables easy and seamless integration with existing payment systems. Financial institutions can leverage APIs and other tools provided by the Federal Reserve to streamline the adoption process.

Regulatory Compliance: As a Federal Reserve service, FedNow ensures compliance with relevant regulations and industry standards, providing financial institutions confidence in their payment operations.

Which way are the Banks tilting?

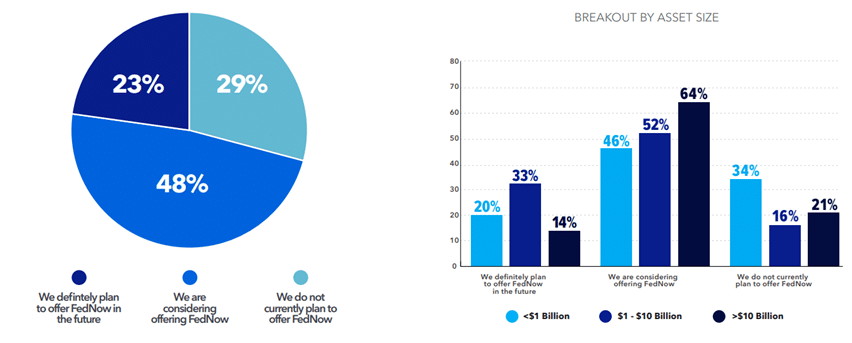

While Federal Reserve isn’t mandating FedNow implementation and each Financial Institution is free to decide for themselves, the trend to get onto the FedNow rails is catching on. Experts suggest that widespread adoption by financial institutions is not a matter of if, but when. According to an IntraFI Survey about the time of the FedNow launch, FIs have shown keen interest in the service. Twenty-three percent of the banks in the survey “definitely plan” to offer FedNow and 48% are considering it. The remaining 29% have no plans to do so.

FedNow implementation can appear daunting as many FIs implementing Real time payments for the first time will require to make infrastructure changes to support a 24/7 payments scheme, involving not just working with the core system provider but also enhancing the way they handle fraud, AML, and customer facing systems, authentication, and notification systems. Starting small, maybe with the “Receive mode” only at first, before taking on more functionality may become the choice of many Financial Institutions. However, starting on FedNow adoption journey is key.

In conclusion, embracing FedNow is an opportunity to future-proof your institution, attract new customers, and foster innovation through collaboration. The system’s real-time capabilities, enhanced security, and ease of integration make it a compelling choice for forward-thinking institutions seeking to elevate their payment services and stay ahead of the competition. We would be delighted to engage with you and your teams to discuss this further and assist in the adoption process. If you’re keen on exploring how FedNow can drive success for your bank, write to us at [email protected]