SLK Software mentioned in the 2023 Gartner®Competitive Landscape: IT Service Providers to the Global Insurance Industry report as one of the example vendors for the Curating and Integrating a Set of Partner Solutions to Build New Business Capabilities for Insurers use case.

Challenging the Insurance Norms: SLK’s Generative AI Revolution

In the dynamic landscape of the insurance industry, acquiring, retaining, and understanding your customers can be challenging. Current technologies cannot address many of these challenges, so they leave much to be desired. This is where SLK stands tall as a pioneer, challenging the status quo. We at SLK don’t merely employ Artificial Intelligence; we usher you into a new era with ground-breaking products backed by Generative AI, Machine Learning, and Data Analytics to help you reimagine the insurance space like never before.

Here, we will take you on a quick journey on how SLK’s inventive, game-changing solutions can help you fast-track your entire insurance value chain with an AI-first approach.

Revolutionizing Insurance Dynamics with Generative AI

Incorporating Generative AI, SLK facilitates a revolutionary transformation of insurance processes, a paradigm shift that was never achieved before. This innovative approach encompasses essential cognitive processes—ensuring consistent decision-making, automation, recommendations, and unwavering compliance. The outcome is empowering insurance companies to take command of their costs, elevate their top line, adhere to regulations, and deliver an enhanced overall experience for end customers.

SLK’s Triumphant Trio: Transforming the Insurance Landscape

1. Underwriting Companion: Achieve uncompromised accuracy in underwriting with the power of Gen-AI

Manual underwriting presents several challenges that impact efficiency, accuracy, and business performance, such as:

- Information overload

- Inconsistent decision-making

- Limited processing speed

- Human error

- Resource constraints

- Incomplete information

- Regulatory compliance

- Competitive pressure

If you are stuck with a manual underwriting process, it’s time for a fundamental shift.

Meet Underwriting Companion, SLK’s Gen AI-powered framework for all your underwriting needs. It helps glean meaningful insights from vast datasets while the machine learning models adeptly discern patterns, correlations, and anomalies in historical data, empowering underwriters to make well-informed decisions. The NLP (Natural Language Processing) enables these systems to interpret unstructured data sources, such as text documents and customer communications, providing a comprehensive perspective on risk factors.

Key Features

- LLM-based Plug-n-Play Solution – Uses AI for automating more complex, unstructured, natural language-oriented business processes.

- Integration with any Web App – Better integration with web applications to cater to multiple insurance types. Embedded UI compatible with most Workflow Management Systems/Policy Admin Systems.

- Unified Solution for New Business, Renewals & Endorsement – Single platform for managing new business, renewals and endorsements that help insurers.

- Easy Onboarding of New Use Cases – Seamless and easy onboarding improves the underwriting experience.

- Quick Adaptability to Changes in Data – Responds to changing market conditions, learning from new data, and adjusting risk assessments. High accuracy at implementation makes quick and accurate policy decisions in a more cost-effective manner.

- Visualization for Business Insights – Interactive and dynamic dashboards designed for business users provide an understandable analysis of your underwriting data.

Differentiators

- Document insights

- Decision support

- Guideline interpretation at a submission level

- Real-time compliance monitoring

- Loss run analysis

- Customized risk assessment

2. DExTr: An ingenious way to extract data from structured and semi-structured documents

AI-based document extraction models improve the insurance industry’s operational efficiency and process excellence. However, they face challenges like:

- Prolonged model training

- Customization of new templates

- Need for experts

- New process requirements

- Extended market time

- Delayed ROI

- Multiple models for different business processes

Meet DExTr – a ground-breaking Gen-AI powered SaaS product that ensures accuracy from the get-go and helps incorporate new document types in just 2-3 days. With its no-code features, DExTr democratizes AI, enabling non-technical users to perform onboarding without the need for AI experts. Its library of preloaded insurance documents and scalability in performance make it a versatile and efficient solution.

Key Features

- SaaS product

- Accuracy 90% + from initiation

- New Doc Type incorporation in 2-3 days

- New business process inclusion in less than 2 weeks

- Visualization for business insights

Differentiators

- Preloaded insurance documents

- Customization via no-code features

- Rapid time to market

- One model for all process automation

- Scalability in performance

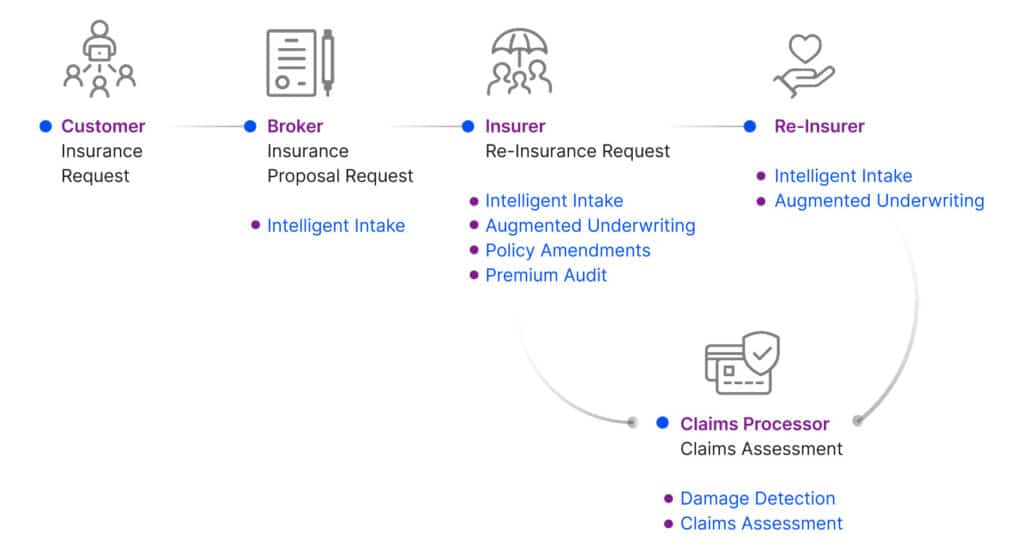

3. INSURAI: Power up your entire insurance value chain

INSURAI reimagines insurance by intelligently managing policy documents, prioritizing brokers, and transforming the claims process. It’s not just about automation; it’s a holistic transformation of insurance operations.

Spearhead end-to-end insurance intelligently

- Intelligent Intake of Insurance Documents

- Intelligent Broker Prioritization

- Intelligent Policy Management

- Cognitive Claims Management

- Intelligent Business Decisions

- Cognitive Customer Sentiment

- Intelligent Damage Assessment

Insurance value chain automation

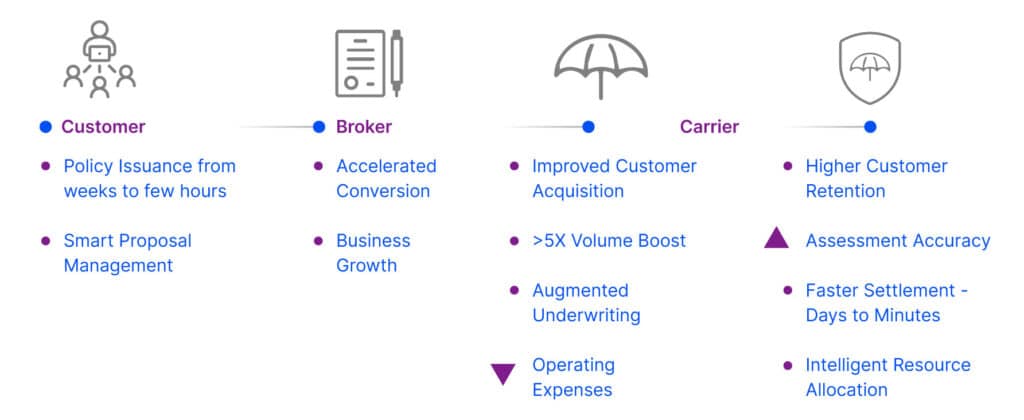

INSURAI Highlights

- Policy Issuance from weeks to few hours

- 5X volume boost in intake

- Faster settlement – from Days to Minutes

Benefits across the insurance value chain

The SLK Advantage: Redefining the Insurance Processes

By deploying Generative AI, SLK doesn’t just automate; it reimagines and redefines insurance processes. Cognitive processes, such as consistent decision-making, automation, recommendations, and compliance adherence, ensure customers can control costs, boost their topline, and offer an unparalleled end-customer experience.

SLK’s flagship products consult documents, understand context, and interact with underwriters and end-users using natural language. They make critical business decisions, from settling claims to pricing products. This level of automation, powered by Generative AI, was unimaginable in the recent past.

A Journey into the Future: SLK’s Vision

As we conclude this exploration into SLK’s game-changing products, SLK’s mission isn’t just to provide solutions, but to revolutionize the insurance industry. Our vision is clear — challenge norms, bring purposeful automation through ground-breaking technology, and usher our customers into a new era where the unimaginable becomes routine.

SLK mentioned in a Gartner report

SLK was mentioned in the 2023 Gartner® Competitive Landscape: IT Service Providers to the Global Insurance Industry report published on 30 November 2023. SLK is mentioned as one of the exemplar vendor for the Curating and Integrating a Set of Partner Solutions to Build New Business Capabilities for Insurers use case.

We at SLK offer rapid deployment capabilities and industry-specific functionalities, which can help businesses manage cost and scale by leveraging digital operations.

Gartner subscribers can access the report here.

Gartner Attribution and Disclaimer

Gartner, Competitive Landscape: IT Service Providers to the Global Insurance Industry, Rajesh Narayan, Jeff Casey, 30 November 2023

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.